When it comes to borrowing money, understanding how long it will take to repay your loan is crucial. Whether you're planning for a new home, a car, or financing education, knowing the timeline can help you manage your finances effectively. In this article, we'll delve into the details of a loan repayment calculator, exploring how it works, why it's important, and how you can use it to make informed financial decisions.

| Sr# | Headings |

|---|---|

| 1. | What is a Loan Repayment Calculator? |

| 2. | Why Should You Use a Loan Repayment Calculator? |

| 3. | How Does a Loan Repayment Calculator Work? |

| 4. | Key Factors Influencing Loan Repayment Periods |

| 5. | Steps to Use a Loan Repayment Calculator |

| 6. | Understanding Loan Amortization |

| 7. | Using the Calculator for Different Types of Loans |

| 8. | Importance of Interest Rates in Repayment Duration |

| 9. | How to Adjust Your Repayment Period |

| 10. | Benefits of Using a Loan Repayment Calculator |

| 11. | Common Mistakes to Avoid When Using the Calculator |

| 12. | Conclusion |

A loan repayment calculator is a financial tool that helps you estimate how long it will take to pay off a loan. It takes into account factors such as the loan amount, interest rate, and repayment frequency to provide an accurate timeline. Think of HERE as your financial crystal ball, giving you insights into your future debt-free date.

Using a loan repayment calculator empowers you with knowledge. It allows you to see the big picture of your financial commitment and plan accordingly. Whether you're budgeting for monthly payments or strategizing to pay off your loan faster, this tool is indispensable.

These calculators use a straightforward algorithm based on the loan details you input. By adjusting variables like loan term and interest rate, you can see real-time changes to your repayment schedule. It's like having a financial advisor at your fingertips, guiding you through complex calculations effortlessly.

Several factors influence how long it takes to repay a loan:

Understanding these factors helps you tweak your repayment strategy for optimal financial health.

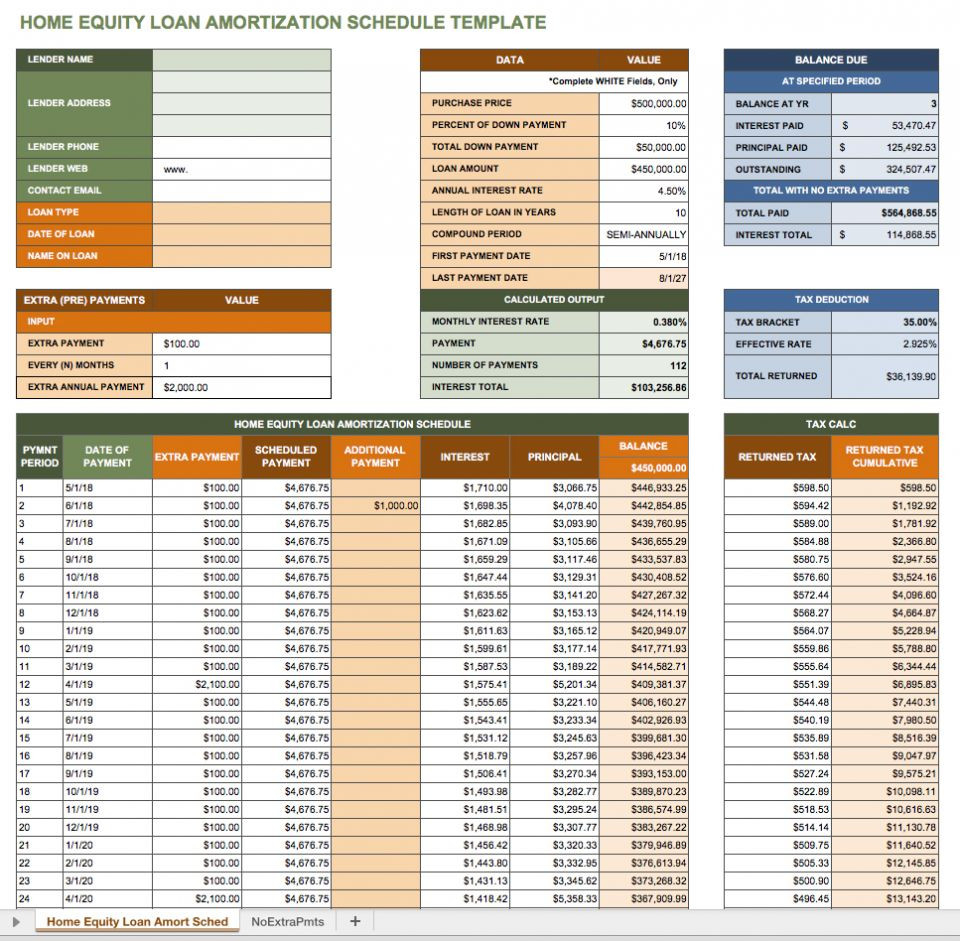

Loan amortization is the process of paying off a loan with regular payments over time. A loan repayment calculator visualizes this process, showing how each payment reduces the principal balance while paying interest.

Whether it's a mortgage, car loan, or personal loan, the principles of loan repayment remain the same. However, https://calculatoronline.icu/cumulative-interest-calculator-excel/ may have unique terms and conditions that affect repayment duration and strategy.

Interest rates significantly impact how quickly you can pay off a loan. Higher rates mean more of your payment goes towards interest rather than the principal, prolonging the repayment period unless adjusted.

If you want to shorten your repayment period, consider making extra payments or refinancing at a lower interest rate. A loan repayment calculator helps you see the impact of these adjustments.

In conclusion, a loan repayment calculator is an invaluable tool for anyone managing debt. By understanding how it works and using it effectively, you can take control of your financial future. Whether you're aiming to pay off a mortgage early or budgeting for a new car, this tool provides clarity and strategic insights.

Loan repayment calculators provide a close estimate based on the information provided. Variations can occur due to changes in interest rates or fees.

Yes, loan repayment calculators are versatile and can be used for mortgages, auto loans, personal loans, and more.

You can adjust your repayment strategy by making extra payments or refinancing to a shorter term loan.

Most calculators focus on principal and interest. Taxes and insurance are typically separate considerations.

Use it whenever you consider taking out a loan or whenever your financial situation changes significantly.

By following these guidelines and utilizing a loan repayment calculator wisely, you can navigate your financial journey with confidence and clarity. Understanding how long it takes to repay a loan ensures you make informed decisions that align with your financial goals.