In today's rapidly changing financial landscape, understanding your credit is more essential than ever. With the recent updates to the FICO credit scoring system, many consumers are finding themselves in need of guidance on how to navigate these changes. The introduction of new credit files presents both opportunities and challenges for those looking to enhance their financial futures.

It's important to grasp how these new credit files work, especially in a world where financial compatibility can significantly impact your ability to secure loans or favorable interest rates. With the right knowledge and tools, you can unlock the potential of your new credit file and take proactive steps towards achieving your financial goals.

FICO credit files play a crucial role in determining an individual's creditworthiness. These files contain detailed information about a person's credit history, including accounts, payment history, and outstanding debts. Lenders use this data to assess the risk of extending credit to potential borrowers. A strong FICO score can lead to favorable loan terms and lower interest rates, making it essential for individuals to understand how their credit files work.

In recent years, there has been growing interest in the concept of a new credit file. This refers to the process of establishing a fresh credit history to improve one's overall credit profile. Whether due to past financial mistakes or limited credit history, some individuals seek to navigate the system by creating a new, clean slate for themselves. Understanding the legal pathways for establishing a new credit file can empower individuals to take control of their financial futures.

However, it is important to approach the idea of a new credit file with caution and awareness. There are numerous legal considerations involved in this process, and individuals must ensure they follow the rules and regulations outlined by credit reporting agencies. Knowledge of how to legally create a new credit file can significantly impact one’s credit journey, ultimately leading to improved financial opportunities.

Creating a new credit file legally can be an important step for individuals looking to improve their credit standing or to establish credit from scratch. One of the primary ways to do this is by applying for a secured credit card or authorized user status on someone else's account. A secured credit card requires a cash deposit that serves as your credit limit, helping you build your credit history without incurring debt larger than you can handle. Being added as an authorized user allows you to benefit from someone else's good credit habits, provided they maintain a low balance and make payments on time.

Another method to create a new credit file is to obtain a credit builder loan. These loans are designed specifically for those with little to no credit history and typically involve borrowing a small amount of money that is held in a savings account until it is paid off. By making regular monthly payments, you establish a positive payment history, which will contribute to your new credit file. This approach not only helps with building credit but also encourages saving, as the funds are released on completion of the payments.

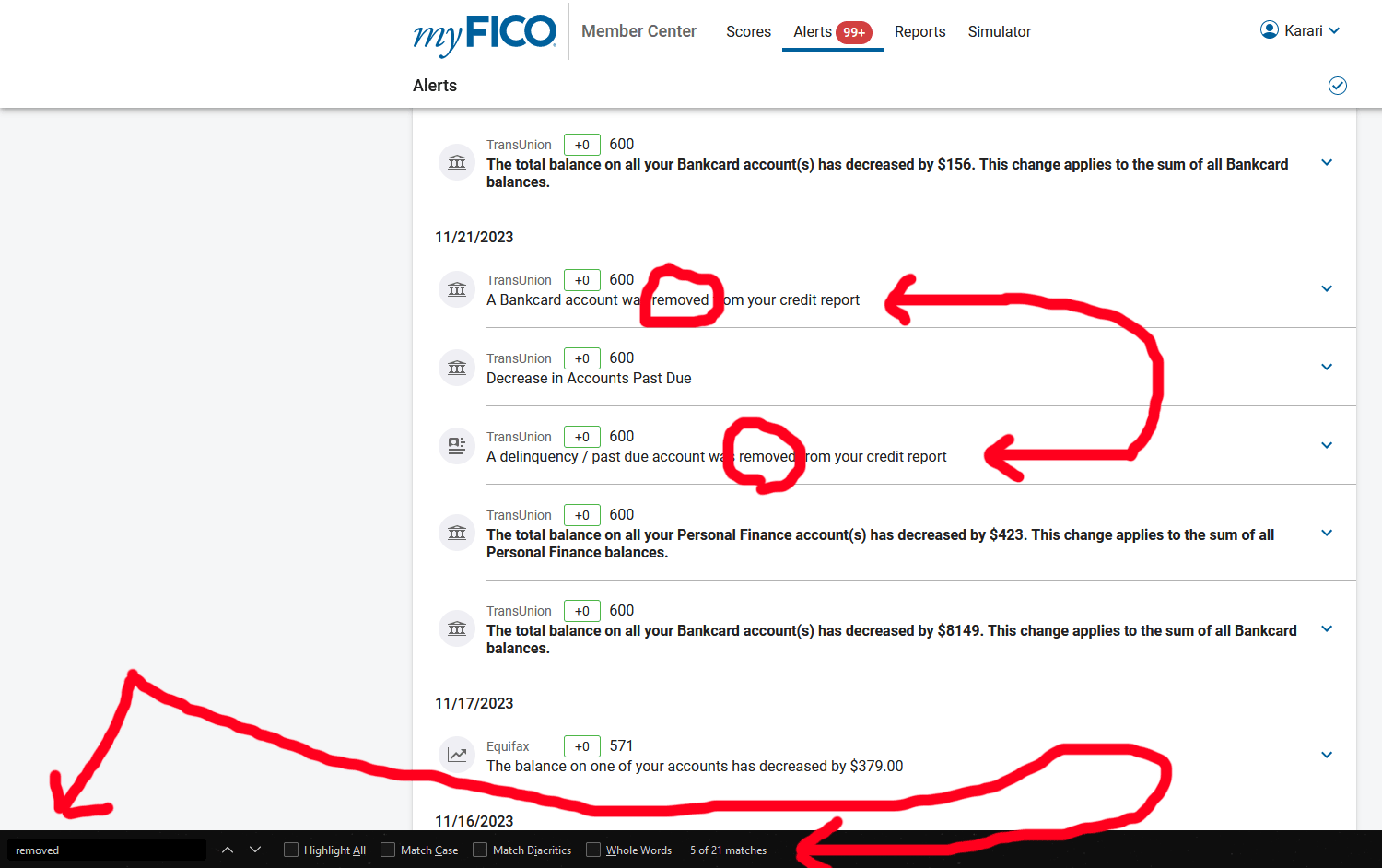

Additionally, keeping an eye on your credit report is essential. You can check your credit report for free once a year from each of the main credit bureaus. Monitoring your report allows you to ensure that all the information is accurate and up to date, which is crucial for maintaining a healthy credit file. If you find any discrepancies, you can dispute them to protect your credit score. By taking these steps, you can legally and effectively create a new credit file that serves as a foundation for unlocking your financial future.

Establishing a strong credit profile is crucial for unlocking your financial future, especially when navigating the new FICO credit files. One effective strategy is to start with a secured credit card. This type of card requires a cash deposit that serves as your credit limit, reducing the risk for lenders. By using the card responsibly and making timely payments, you can demonstrate your creditworthiness while establishing a positive credit history. Over time, this can lead to opportunities for unsecured credit options.

Another important strategy is to diversify your credit mix. Having different types of credit, such as installment loans or revolving credit, can enhance your credit profile. For example, if you have a secured credit card, consider adding an installment loan like a personal loan or auto loan. This diverse approach can improve your credit score by showing that you can manage various forms of credit reliably. Always ensure that you can meet your payment obligations before taking on new debt.

Finally, monitoring your credit regularly can help you stay informed about your financial standing. Use free credit report services to keep track of your progress and correct any inaccuracies that may appear. Being proactive about understanding your credit profile allows you to make informed decisions and address issues before they become significant problems. By following these strategies, you can build a solid credit profile that will serve you well in navigating the opportunities presented by the new FICO credit files.